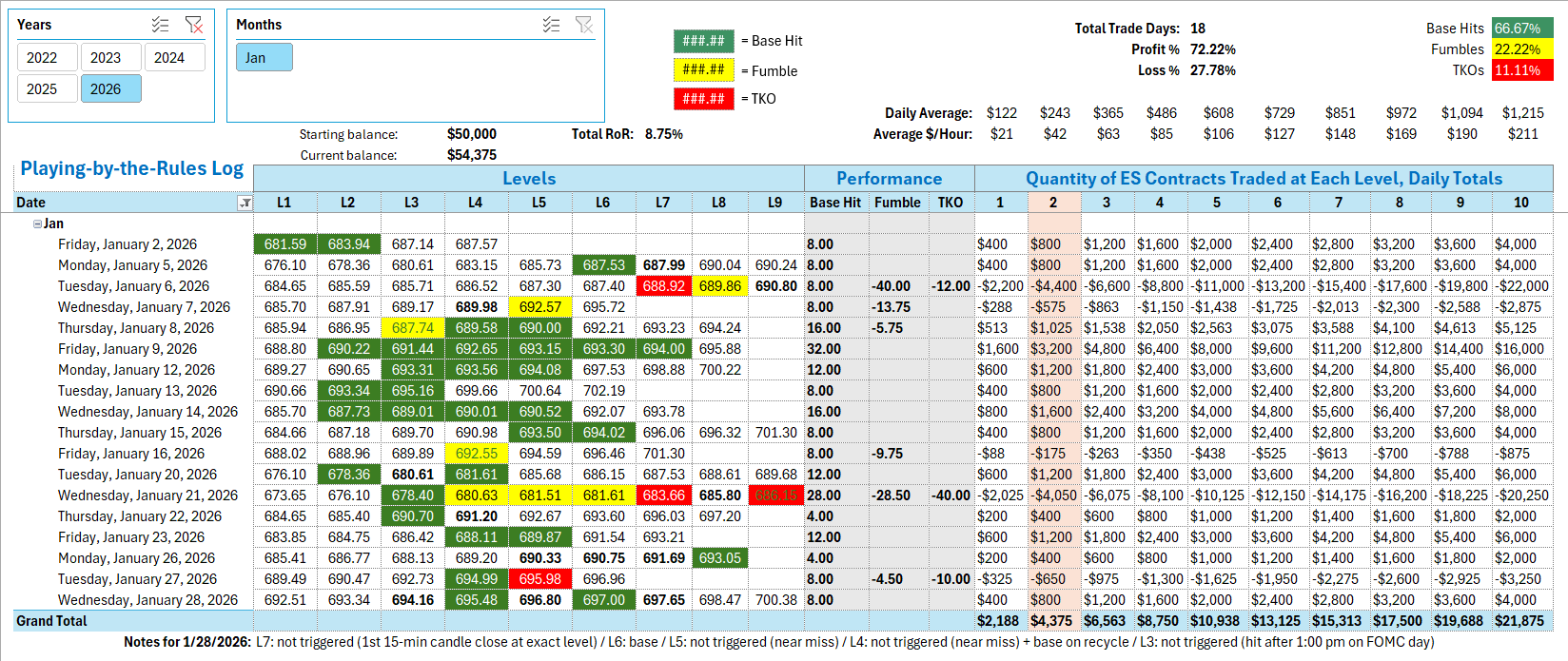

SPY Levels & Game Plan

Wednesday, January 28, 2026

9:20 am Eastern - Today is the Fed's interest rate decision and announcement day. The news that comes out at 2:00 pm Eastern will likely push price around in the SPY/ES. So our rule is to not enter any new positions after 1:00 pm. Levels can still work leading up to and after these Fed announcements - and they often do - but the odds are high that levels would be spiked a lot and that would make trading them difficult. When volatility is increased, stepping back and observing is usually a safer bet.

Yesterday the SPY made a new high and then pulled back a little at the closing bell. In the overnight session, the futures continued the bullish grind higher and price has already tagged some overhead resistance levels we identified yesterday - and some on the board for today. They can still react again off these levels during the regular session, so they're still on the board. The SPY is so close to 700 now that it would be entirely feasible for them to try to tag it. Same thing for SPX. 7,000 is still a target. I always like speculating where the professionals and institutions would like price in the SPY to be leading up to 2:00 pm on FOMC / Fed days, like today. It's mostly a guess based on prior price action - and this is certainly not any kind of information to trade off of, but I wouldn't be too surprised if price is around 695.00 at 2:00 pm Eastern today. Again, this is just a game, as far as I'm concerned. It's not information that should inform any kind of trade. Base hits in the ES when price interacts at our SPY levels of probable support and resistance and the best way to pull points and dollars from the market on a consistent basis, in my opinion.

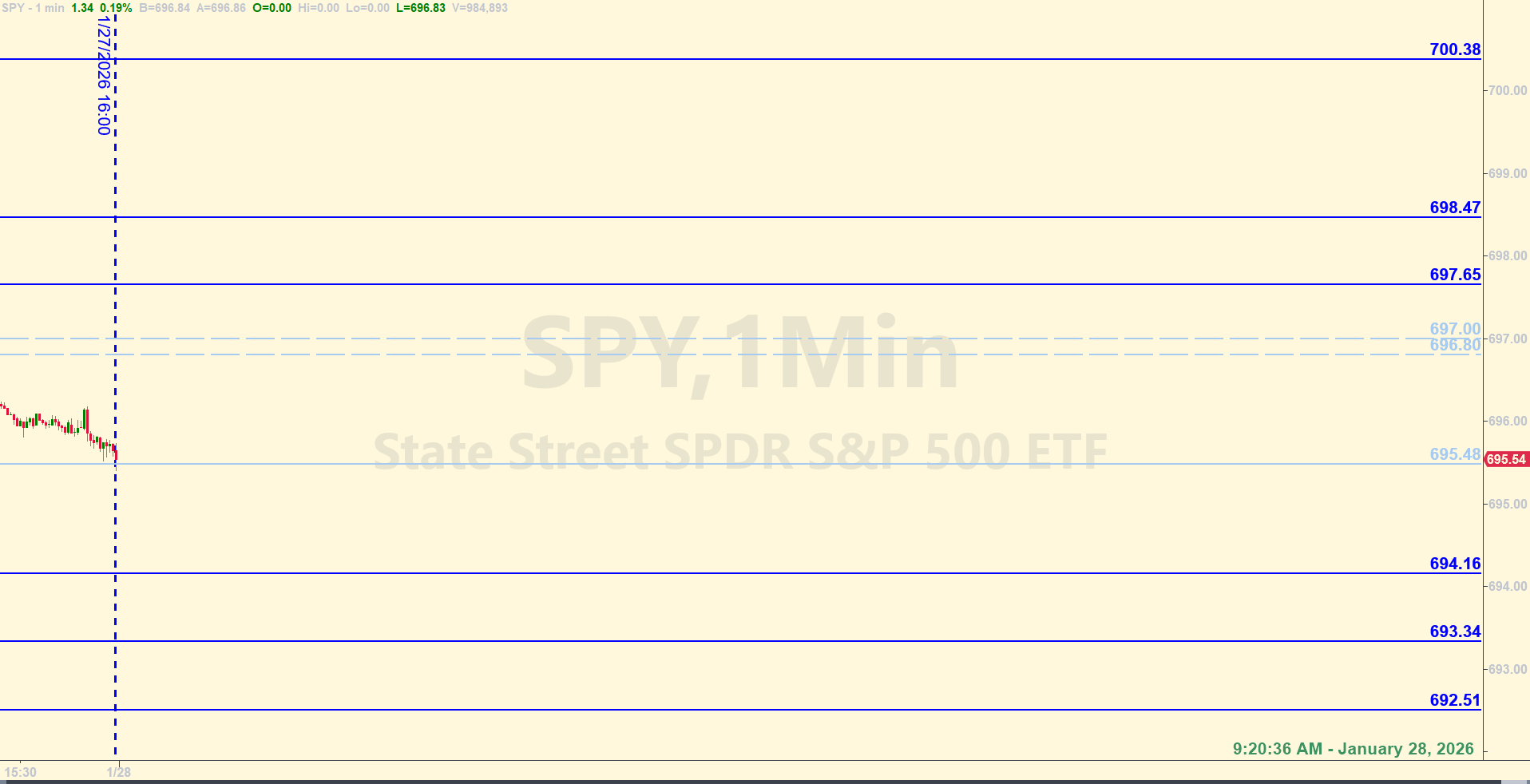

There is a zone between 696.80 and 697.00. This is like one fat level that will serve as our bull axis for today. Price will need to stay above this area for the bulls to continue climbing. They can dip below and it won't become a problem for the bulls until or unless they start closing hourly candles below 695.48. The 695.48 level is the bear axis for the time being. The big picture is still very bullish, so getting below 695.48 won't spell immediate doom for the bulls - it's just the first door for the bears to try to get more selling going to pull price down more, if they want to try. There are other levels of support lower down that are all important in their own right. In a normal acting market, those levels are probable support areas - usually enough for base hit reactions in the E-minis. Trade well today.

After the closing bell...

Trading by the Ticks & Trades Strategy, here is where you would have landed for the day:

At the 9:45 am candle close - or whatever the first 15-minute candle is in your time zone - price was at exactly 697.65. If price was under the level by a few cents or more and came up into the level, you would have shorted E-mini contracts when the 697.65 was hit. Or if price was above that level and was coming back down into it, you would have gone long with E-mini contracts. But since it was at the level exactly when the window of opportunity was opened, no trade was entered. Price could have gone either direction. Earlier, in the second minute after the opening bell, price had already hit the level and pulled back about 6 ES points or so. It was possible price would react and pull back again from the level - but it was also possible the bulls were trying to get on top of the level and use it to launch higher. So, net-net, no trade at 697.65.

The first official Base Hit trade was a long at 697.00 at about 9:48 am. That worked well for a quick, profitable trade. In getting filled at that level, price almost got down to the bottom of that zone and came close to hitting 696.80. But they didn't hit 696.80 before bouncing, so that's a Near Miss. The next time price came down into 696.80, you didn't attempt going long there because the first hit is the best hit.

Once price got below the zone, they fell down into the next level lower - which was outlined in the Game Plan from the morning. 695.48 was good support, but the long trade was not triggered because of a 1-penny Near Miss of the operating level at 11:00 am. Strictly playing by the rules, there was no official trade at 695.48, although you can see that the level did work as support. It was important.

When price got under 695.48 for the right amount of time and came back up into it at 12:14 pm, a Recycle trade on the short side handed you Base Hit number two. After that trade, no other levels were hit before 1:00 pm, and as we explained in the Game Plan from the morning, there are no new positions taken after 1:00 pm. on FOMC days. It is interesting to note, though, that after the Fed announcement at 2:00 pm Eastern, price fell right down into 694.16 - the next level down that hadn't been hit yet, and bounced nicely. They bounced there a couple more times too, reinforcing the fact that 694.16 was important. But we're not counting a Base Hit trade there since we're sticking to a precise process.

Notice the second "After the closing bell" screenshot above - the one with the post-market data turned on. Look where price went after the closing bell today. Back down to 694.16, then quickly down to 693.34 and bounced more than enough for a Base Hit there. Then down to 692.51 almost to the penny, and bounced again. Then price climbed all the way up to the zone where they spent some time messing around with early in the regular session. Just look at what price did when it hit those levels again. Do you think there is something to these Daily Levels that we find to trade against every day? They were very important today.

Also, remember how in the Game Plan we speculated that by 2:00 pm, price would likely find itself down in the 695.00 area? When I wrote that, price in the premarket was about 20 S&P points above 695.00. And guess where price was about a minute or so leading up to the news release at 2:00 pm. Just pennies away from 695.00. Another interesting thing to observe, wouldn't you say? How could I possibly know that that was likely to happen? We'll just save the details about that for a later discussion.

Per the rules, a total of 8 ES points for the day.

Tracking log to-date for 2026: