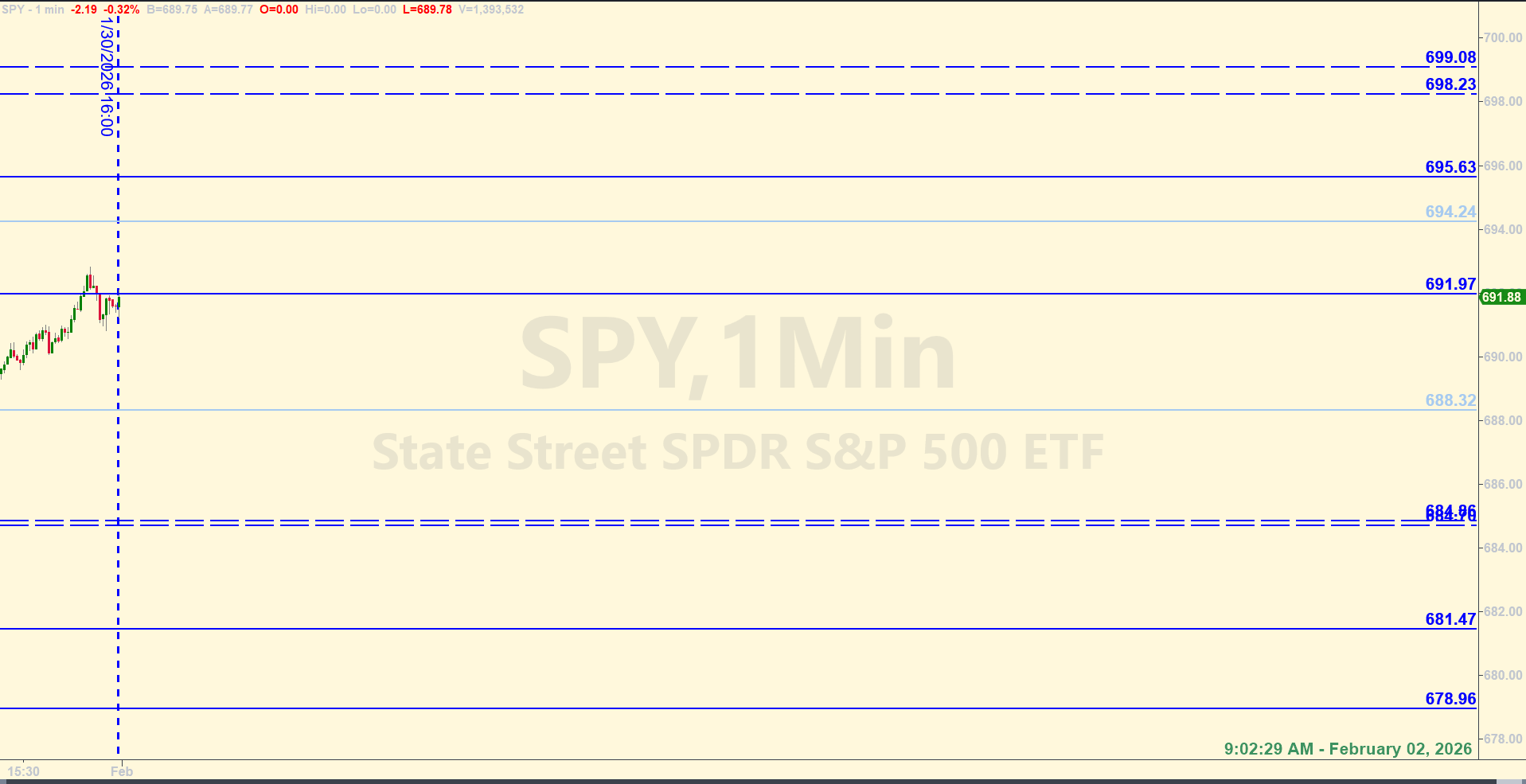

SPY Levels & Game Plan

Monday, February 2, 2026

9:02 am Eastern - We're into February now, and things could get interesting. In the big picture, starting with the monthly chart of the SPY, things are still bullish. Same with the weekly and daily charts. When we get down to the 4-hour charts and pretty much all the other multi-hour and sub-hour charts, there are bearish signals showing up. The bulls have been facing a lot of overhead resistance lately and it's been challenging for them to stay at the highs. They keep getting rejected. The bulls need to get above and close hourly candles above last Friday's high to be in a better position to climb out of where they are now. 694.24 is the bull axis for today. It's less of a tradeable level and more of a gauge. I wouldn't trade against 694.24 unless I saw other compelling reasons in real time that there would be additional overhead resistance up there.

The bear axis is 688.32. This is an area that price has been fighting in the premarket. Staying above 688.32 and the levels above current price could come into play as the bulls try to regain lost ground. As I write this, with about 40 minutes before the opening bell, price above the level, and it looks like the bulls used the level to launch from. This is just the premarket though. After the opening bell, it's very feasible for this level to be retested. The bulls will probably try to defending it. If the bears succeed in pulling price below 688.32 and keeping price under on hourly closes, there are likely targets farther down that the bears have in their sights.

I would look at the lower zone between 684.86 and 684.70 as one fat level. If price gets back down there the right way, that area could be a good place to go long, so scaling in and/or adjusting position size as necessary to manage risk is a good idea. Again, consider that general area around those two levels that comprise the zone as one level.

At the top of the board we have another larger zone between 698.23 and 699.08. That is above the current all-time high, and could present a challenge for the bulls to stay above. SPY 700 is a psychological target though, and that is not much farther above the top of the zone - less than one dollar. So if the bulls happen to rally all the way up there today, it would be a good place for them to take a break. It's very likely 700 is already being shorted. It's a place where profits will be taken. While price could bust through the 700 ceiling and keep going without even looking back, it's more likely a bull/bear battle will take place at that area. There's a lot of room for price to go in either direction. Maybe not today, but at some point the next leg in the market will become evident.

There is a 10:00 am Eastern PMI data release that has the potential to move price around. Be aware of your surroundings leading up to that event. Otherwise, stay alert and trade well today.

After the closing bell...

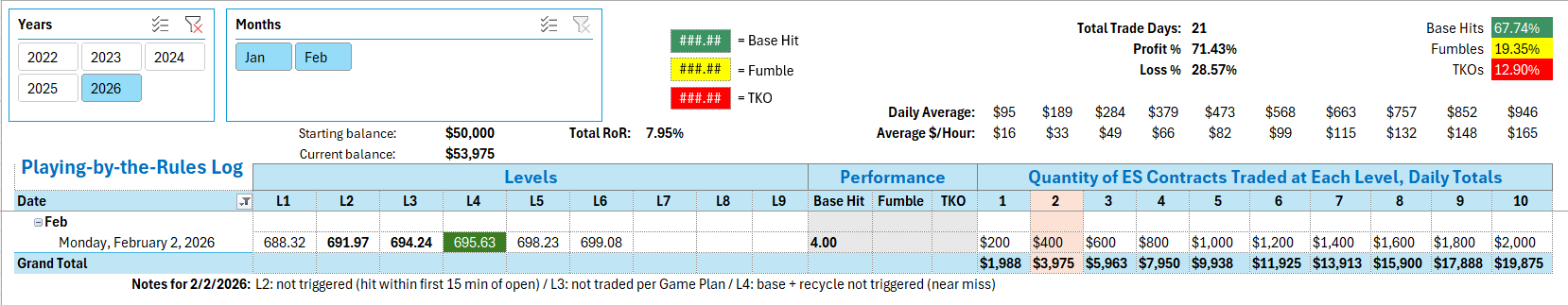

Trading by the Ticks & Trades Strategy, here is where you would have landed for the day:

The big-picture bullish sentiment held today. Price opened above the bear axis level of 688.32 and never got down there throughout the session. After the first 15-minute closed, price was above 691.97 and then they pulled back and almost hit it on the long side at 10:00am. But the bulls got price to move before the level was hit, so no trade at 691.97. Front runners at work.

We were not planning to trade against 694.24 per the Game Plan from the morning (see above). 694.24 was the bulls axis for today and we wanted to see if the bulls could stay above. Price got above it easily at 10:07 am and went up to 695.63. Going short against 695.63 gave you a Base Hit. When price bounced off 694.24 from the top right after 11:00 am, that helped confirm that the bulls had the ball. We didn't trade on the long side of 694.24 - again, it was the bull axis gauge. There was a chance that the bulls couldn't sustain closes above the axis and we didn't want to be on the long side if the bulls failed to defend that area. But staying above the axis level was generally positive for the bulls, and that's why we use gauges like this.

Price got above 695.63 and came back down to test it from the top around 1:23 pm. Even with the 5-cent buffer, which put the operating level at 695.68, the long trade there wasn't triggered. They found a low of 695.69 at 1:23 pm. That was a 1-penny Near Miss before price took off again and continued to climb. That's a little bit of a heartbreaker. Only one penny away from a good trade. This will not be counted as a Base Hit trade per the rules, but hopefully you can see how 695.63 was an important level. Like all the levels each day, 695.63 was identified long before the opening bell this morning. And, as designed, it provided resistance (then support) as price interacted with it. Another good day to have the levels handy to trade against.

Per the rules, a total of 4 ES points for the day.

Tracking log to-date for 2026: