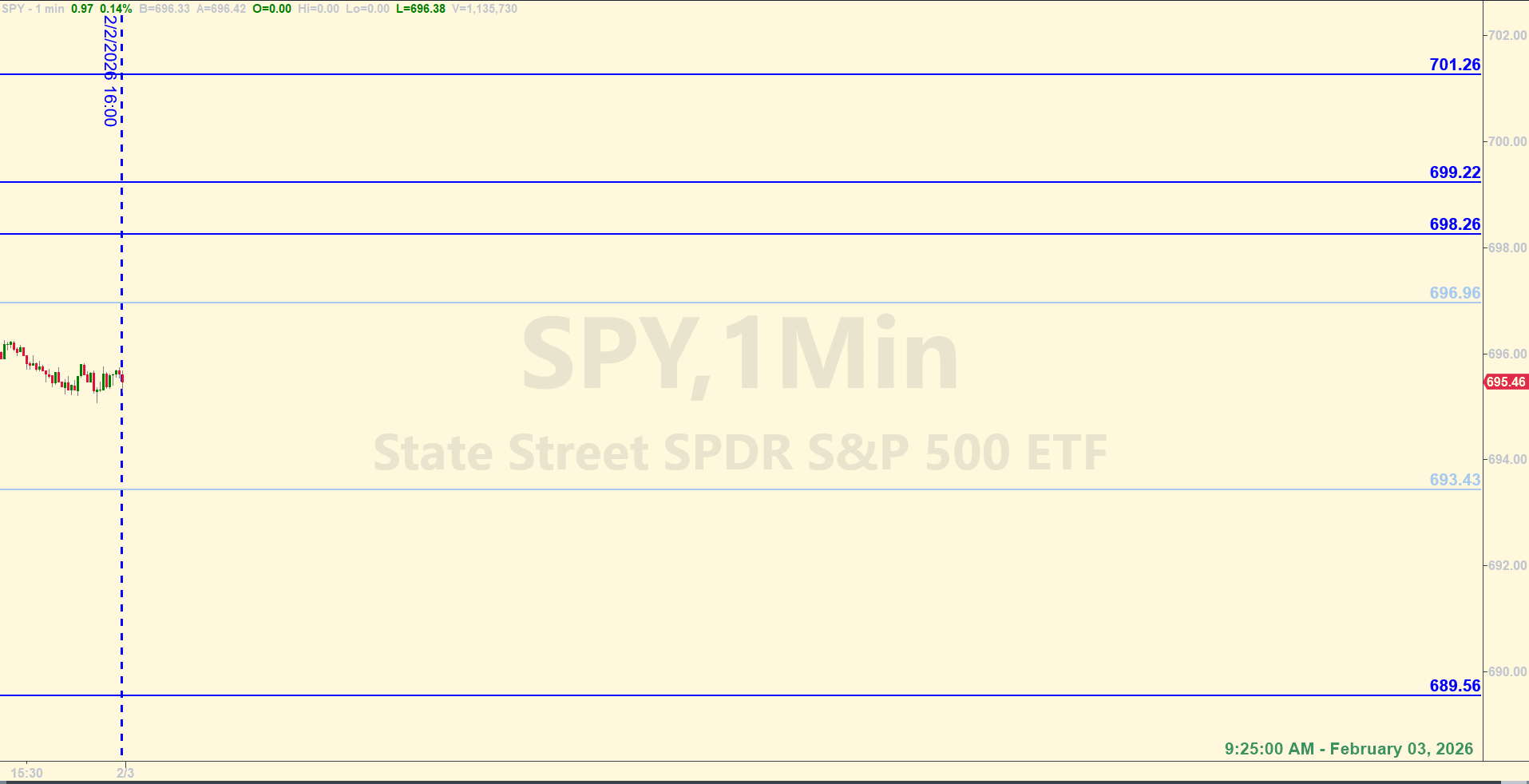

SPY Levels & Game Plan

Tuesday, February 3, 2026

9:25 am Eastern - The SPY is still targeting 700 and if the bulls can break above some important areas - including a longer-term trendline - then 700 is within range. The level at 696.96 is the bull axis. Staying above is good for the bulls. Getting a 2-hour close above 697.00 will start to deteriorate the importance of a bearish consolidation that has been developing on the 2-hour chart of the SPY. Spiking above is not an issue for the bulls. What we're looking for are 2-hour candle closes above 697.00. That would be a good sign that the bulls can get to 700 easier. (keep refreshing this page as I continue to develop this Game Plan...)

I'm still writing this after the opening bell. It is 9:32 am Eastern currently. Price has already come up and hit 696.96 to the penny and has pulled back a little. We don't enter trades until after the first 15 minutes of the regular session, so it's ok. We want to see if the bulls can stay above this level, as it is our axis and gauge for potential higher prices.

Under 693.43 and closing hourly under it could mean the aforementioned bearish consolidation pattern is playing out normally. The level at 693.43 is the bear axis. There is a relatively large amount of space between the lower levels, and that's intentional. Price can grind higher and the bulls can work hard to fight the overhead resistance to get to 700 and higher, if they are able. But if price falls hard for some reason, I don't want a lot of levels under current price that may or may not work with increased volatility. Not saying anything in particular is going to happen - like a big drop. But it's just awareness of what could happen at times like this. There are a lot of shorts in the market against 700 right now and that could turn the tide at some point. Big picture is bullish, but as we've been saying there is still a lot of room for resets on the downside. Trade well today.

9:40 am: Just want to point out that at 10 minutes after the opening bell, that price is bouncing from yesterday's close at around 695.46, which is the gap left open from yesterday. If the bulls hold this area, they may be able to get above the bull axis and keep climbing. If they break below 695.46 and start closing below it, it opens the door to the bear axis at 693.43.

9:58 am: Another update. Now that 's after the first 15 minutes of the open and trades are viable now, the bull axis at 696.96 may become less important as overhead resistance the more price hangs out under it. The more they go sideways - or go lower, looking for a place to bounce for a reset, the better chance the bulls have of busting through it and going higher - if they get back up there within the next 30 minutes or so. I'm not sure I'd want to trade against 696.96 now. There has been a lot of attempts at breaking above, and the next time it gets tested, it might be the time the bulls can get though it. I'm using 696.96 as a gauge only for today. Don't forget that the big picture is bullish. Meanwhile, the bear axis at 693.43 is coming into view...

After the closing bell...

Trading by the Ticks & Trades Strategy, here is where you would have landed for the day:

Right out of the gate, the SPY tagged 696.96 and hit it to the penny. That happened within the first 15 minutes of the opening bell, and if we're following the process, we don't enter new trades in the E-minis during that 15 minute window. Today was one of those days where breaking that rules and going short at 696.96 at 9:32 am would have worked well. But many times levels that are hit during the first 15 minutes don't react the right way at our levels. For all we knew, today was going to be the day the bulls tried for 700 and busting through that first resistance level would have been their first order of business. Clearly, the bulls got spanked today and they didn't bust through that resistance. But, in any case, no trade at 696.96. It was an important level though, as you can see.

Going long when the SPY hit the bear axis of 693.43 was when you entered your first trade. The bearish momentum was strong and the level didn't hold - not enough reaction - and there was a Fumble for a 10-point loss. Then the reversal gave you a Base Hit's worth of points (or more, if you were willing to hold longer) to wash some of the loss.

Then price came back up to 693.43 from the underside, and as we've mentioned before, when a level doesn't hold as support, it almost always works as resistance for a short trade if/when price comes back into it from underneath. So the Recycle trade on the short side at 693.43 gave you a Base Hit. It's worth pointing out that when price did come up into the 693.43 at 10:57 am, resistance was established at the level exactly. They hit it to the penny and fell away fast. Another important level from the morning Game Plan. Because price couldn't get back above on this retest, that was the market's way of telling you that lower prices were coming. Remember, 693.43 was the bear axis for today.

Price then fell hard into 689.56 during the 12:13 pm candle. They bounced there, but came up too close to the profit objective before reverting back to the entry point quick enough to not trust the level to hold for a second attempt at a Base Hit. Per the rules, you jumped out at breakeven. A few minutes later, price bounced more than enough for a Base Hit, but we're not counting this trade as an official Base Hit. By the way, there was a safety net from another level under 689.56 at 688.72 that would have helped pull in a Base Hit by averaging in across those two levels. But it was not on the board for this morning, so we're not counting it. I happened to scale in there and pulled about 10 points. But I also lost points/dollars on the Fumble at 693.43 with that first hit at 10:00 am. So, not the best day. But sticking to the process kept you out of trouble.

Per the rules, a total of -2 ES points for the day.

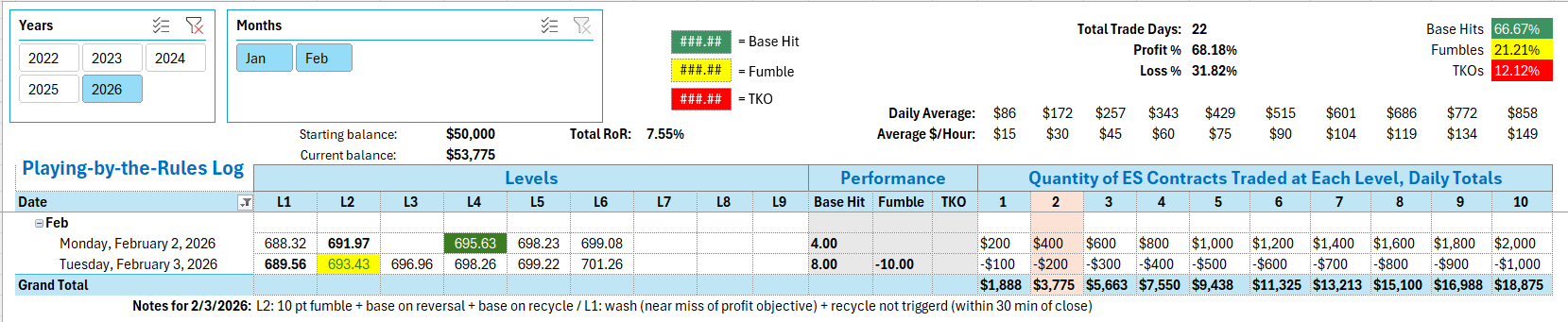

Tracking log to-date for 2026: